Brooklyn and Queens have never been this expensive by Emily Nonko

(http://ny.curbed.com/2016/10/13/13257034/brooklyn-queens-sales-market-manhattan-rentals)

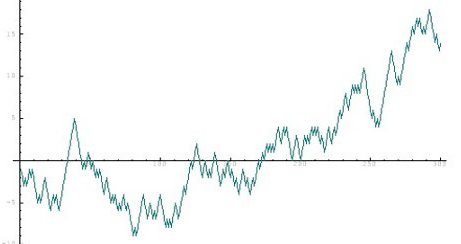

This article focuses on home sales in Brooklyn, Queens and Manhattan. Home sale prices have reached a high record for the third quarter of this year. There are many factors that contribute to this increase in sale prices that in turn create a decrease in inventory available for sale. Prices are escalating without negotiations between sellers and buyers. Investors conveniently are launching several apartment listings that end up spending more time on the market due to being placed in a high price bracket. As a result, buyers are being presented with a large supply of options, however all of this supply is priced at the higher end. One graph in the article is used to support the information presented on the borough of Brooklyn:

The graph displayed is from the Brooklyn Concoran’s Group Resale condos data and it is used in the article to show the comparison of this year’s third quarter (3Q16) with last year’s third quarter (3Q15) in condos resale in Brooklyn. The graph uses data of several condo listings that the Brooklyn buyers have at their disposal on the housing market. It demonstrates that with only 4% increase in developments (inventory), the market for resale condo is still yielding strong sales with a 9% increase in price value. The condo resale prices are not only above median price but also above average price between these two quarters. This graph demonstrates that the record increase in Brooklyn home sale price is still going up. A prosperous outcome for investors selling property in Brooklyn.

For more information, the remaining two graphs are from the Concorran’s report (link found at the bottom of the article under sources) that illustrate resale condos prices at a steady increase from 3Q8 until 3Q16 and a more graphic representation of the increase in median and average price value over the last two quarters 3Q15 and 3Q16.