After three years of being in a relationship I realized that being with another person is expensive. Seriously! When I was single, the only gifts I would normally buy were for my immediate family on holidays like Christmas and their individual birthdays. Now that I have a boyfriend, I feel like there’s a holiday every month, or at least that’s how it can seem. Being in love, and caring for someone else along with yourself can be expensive for both parties. Celebrating birthdays, holidays, anniversaries; even just going out on spontaneous dates starts to add up and take a toll on your bank account. As a college student, I have to budget my money for five main things: food, transportation, books, family events/gifts and “me time.” Now that I am in a relationship, I have to restructure the set-up for my budget to include another person. I noticed that being in a relationship caused a radical change in my spending and I realized a change needed to be made. So my partner and I sat down one day and decided to figure out a way to maximize the time we spend together, while also cutting back on the amount of money we spend on each other. I know you may be thinking what kind of relationship are you in? Why would you want someone to spend less money on you? Who wants to be in a relationship with a cheap partner? My answer to this would be “We aren’t cheap. We are just budgeting our relationship.”

I don’t know about other couples out in the world, but my boyfriend and I are still trying to establish ourselves financially so that we can live comfortably when we get older. We are both talented individuals aspiring to achieve all of our dreams, but in order for those dreams to come true, we feel we need bountiful savings accounts. Unfortunately, going out on fancy dates every other day isn’t conducive to the lifestyle we both want to live when get older. So after much consideration we decided to establish a budget system that helped us not only save money, but also brought us closer in the process. Below I will list some of the steps that we took to start budgeting our relationship, and increasing our bank accounts.

Step 1: Be honest. If you don’t have the money to go out, tell your significant other that. Don’t be afraid to tell them that you can’t afford a certain restaurant because you need to pay your phone bill. Pay your phone bill and then explain to the person you are involved with the situation, and suggest another way for you both to spend time together.

Talk about your finances. The best thing you can do in a relationship is communicate with the person you are involved with. Tell them about your plans for your money, your dreams, your aspirations, and how you want to spend your money in the future. Let them know why you don’t want to spend hundreds of dollars on a meal that will only satisfy your hunger for a few hours before you have to make a Mcdonalds run. Your partner may be more understanding about your spending habits if they understand why you are saving.

Step 2: Take the Time Out magazine when the person outside of the train station tries to hand it to you. This magazine has so many affordable date ideas that you can attend in Brooklyn, and the other boroughs. All you have to do is read through the magazine and you are definitely going to find something that interests you. Personally I found an art exhibit for my favorite artist Kara Walker, and the best part was that it was free!

Step 3: Stay home some time. Make use of your Netflix subscription or your on-demand, or your fire stick. Pop some popcorn in your microwave. If you don’t want to watch a movie, make a home-cooked meal. Cooking at home is a great way to improve your skills in the kitchen, while also saving money. So, chef it up!

Step 4: Make date night epic every once in a while, instead of every week! Save your money for a few weeks, as Yo Gotti would say “Rake it up, Rake it up.” Then when a month or so goes by and you have accumulated a good amount of money in your account, take a small portion of that money and do something nice. Go to one of those fancy movie theaters with reclining seats, buy popcorn instead of sneaking in your own outside snacks. Ha! Most of all just enjoy the time you spend with your special person. After enjoying your date with your special someone, get back to the grind and continue to save your money.

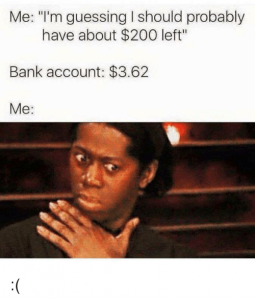

Step 5: Go after sales! There is nothing wrong with catching a deal for half price. A gift that was originally $250.00 is still the same gift even if you catch it on sale. There is nothing wrong with utilizing sales and most of all getting coupon codes from Retailmenot.com, or even Groupon! There’s no shame in saving money. At the end of the day, your partner will still have an amazing gift or dinner, and you will be able to look at your bank account without getting chest pains.

Retrieved from Pinterest

If I have learned anything from being in a relationship, it’s that there are much more important things in life than money. My boyfriend and I have had more fun going out to a pier, eating at a local chinese restaurant, and taking long walks than we have had at upscale restaurants. I mean, sometimes it’s nice to be “wined and dined” but no one likes to see a $400.00 bill at the end of the night. Sometimes it better to just hit up a restaurant that sells affordable food so that you can stretch your money. Be reasonable and think logically: The $400.00 that you spend for one meal could get you a dinner, a movie, and a mini shopping trip if you manage your money correctly. Think about quality rather than quantity. Consider how much you can get for your dollar rather than just purchasing something because its expensive and in style.

Trust me, if you start to live your life using these suggestions, you will see drastic changes in your relationship. This counts for friendships as well. I suggest that you and your significant other discuss the changes you want to make in your relationship first. Then, if you both agree on making the changes, implement the steps into your relationship slowly. Give it a week or so and then leave me a comment and let me know if the steps above worked for you or if they didn’t. I would love to know if any of the changes I adopted in my relationship can help others as well.

First of all…. that picture is FIRE Cherishe! Lol. Congrats on your beau, you look so spiffy together! And as for the advice, my fiance and I have been implementing those guidelines in our own relationship and it’s helped us a lot. I’m more of the spender and he’s more of the saver, so we find ways to balance it all. Our dates can range from a workout at the gym and food at my family’s house, to Red Lobster on our dating anniversary. We know a lot of cheaper but great quality places in our neighborhoods, like Chikurin, a charming Japanese restaurant; so we tend to frequent those. I think you guys are very smart for being honest and rational about your financial decisions.

Hey Robine,

Thank you so much for the compliment on our picture!

We were going out so we decided we should get a picture to remember the moment. As far as budgeting relationships goes, I’m so glad that you suggested gym dates because I have been considering going to the gym with him. OMG! You mentioned Red Lobster as a date. I love Red Lobster’s biscuits and their Ceaser salads. I’m digressing here, but I am interested in trying new affordable restaurant so I’m going to look into the restaurants you provided above. They sound delicious!

I agree, Robine. That pic is fire!

Cherishe, I agree with you about TimeOut magazine. I love those things! Not only does it inform you about all the cool and current events taking place around the city but, it’s also really funny and enjoyable to read. It’s THE perfect resource for cheap dates or just a cheap reason to get out of the house and meet new people.

Hey Sabrina,

I’m so glad that you are familiar with The TimeOut magazine. People aren’t always aware of how much you can learn by just flipping through the pages of the magazine. It so resourceful, and there are so many activities to get involved in, free activities at that. Who doesn’t like to have fun and still have money in their bank account?

Cherishe, you and your boyfriend are adorable together…nice picture. I love your ideas…I personally abuse the use of retailmenot to benefit from an unlimited amount of discounts. You can also apply for an IDNYC card which allows you to get discounts at museums, aquariums, and a lot of other places.

Hi Bri,

Thank you so much for the compliment ! You and I are in the same boat when it comes to utilizing the coupons on Retailmenot.com. However, I was not aware of the discounts available if I apply for the IDNYC cards. I’ll have to look into the possibility of signing up for a card. Thank you so much for the suggestion.