Quantitative Reasoning Sample Project I:

Brooklyn Real Estate and Gentrification (Download Full PDF with instruction: Click here)

Research Questions: From 1990 to 2000 rent prices increased sharply throughout Brooklyn. Which of the following variables do you think had the strongest relationship with these increases in rent prices: the percentage of people of color in the neighborhood, the percentage of total renters in a neighborhood, or the median income in the neighborhood?

Assignment: provide at least ½ a page (typed) including the following information:

1. What is gentrification?

2. Which three neighborhoods in Brooklyn do you think have had highest increase in rent from 1990-2000 and why do you think that?

- Which of the following variables do you think had the closest relationship with these increases in rent prices: the percentage of people of color in the neighborhood, the percentage of renters in a neighborhood, or the median income in the neighborhood? Why?

Need Help Getting Started? Below are some suggested sources for background reading:

- Gentrification:http://observer.com/2015/01/gentrification-may-be-complicated-but-its-not-a-myth-and-neither-is-displacement/

- http://www.slate.com/articles/news_and_politics/politics/2015/01/the_gentrification_myth_it_s_rare_and_not_as_bad_for_the_poor_as_people.single.html

- Brooklyn Rent Trends: http://www.mns.com/brooklyn_rental_market_report

- Current Rent Maps: http://ny.curbed.com/archives/2015/02/16/mapping_the_cheapest_priciest_places_to_rent_in_nyc.php#more

- NYC Rent Price Determinants: http://www.michiganjb.org/issues/1/article3.pdf

Quantitative Reasoning Sample Project II:

Hudson River Project: Dissolved Oxygen in the Hudson Rive (Download Full PDF with instruction: Click Here)

Research Questions: How do the dissolved oxygen levels in the New York Harbor change over the course of the year? What causes these changes, and why are they important?

Assignment: provide at least ½ a page (typed) including the following information:

1.Why is dissolved oxygen in water important?

2.What is the New York safe fishing standard for dissolved oxygen?

3.What do you predict the relationship between oxygen levels and time of year in the Hudson River will be?

4.Explain WHY you think that.

5.You must provide at least TWO sources as part of your answer.

Here are some suggested sources for background reading:

- Basics of Dissolved Oxygen in Water: Click Here!

- State of the NY Harbor Report: Click Here!

- New York Water Quality Standards: Click Here!

Quantitative Reasoning Sample Project III:

Climate Change in New York City (Download Full PDF with instruction: Click here: ClimateChangeProject)

Research Questions: Which climactic element: air temperature or precipitation is expected to change more drastically as climate change progresses.

Assignment: provide at least ½ a page (typed) including the following information:

1. What is global climate change and how is it caused?

2. What are some major impacts global climate change is expected to have on NYC? 3. Which climate element do you predict will change most drastically in the future?

4.Explain WHY you think that.

5.You must provide at least TWO sources as part of your answer.

Here are some suggested sources for background reading:

- Global Climate Change Basics: Click Here!

- Climate Projections for NYC: Click Here!

Quantitative Reasoning Sample Project IV:

City Rats (Download Full PDF with instruction: Click Here)

Research Questions: Which Borough in NYC has the most rats?

Assignment: provide at least ½ a page (typed) including the following information:

1.Why are rats a problem in cities? 2.What NYC borough do you think will have the most reported rat sightings? 3. Explain WHY you think that.

4.You must provide at least TWO sources as part of your answer.

Here are some suggested sources for background reading:

- Rats in Big Cities: Click Here!

- Rat Map of NYC: Click Here!

Quantitative Reasoning Sample Project V

Finance Project (designed by Melanie Lorek, City Tech QR Fellow)

Click here to download the FinanceProject (PDF)

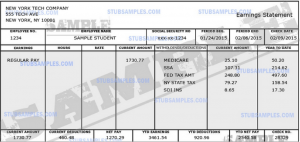

After graduating from NYCCT you landed a job earning 45k/ year. Congrats! Now it’s time to think about your long term life goals. Do you want to buy a car, a house, save for retirement, and attend grad school? Based on the information below and your bi-weekly income displayed in the pay stub below, compute the monthly costs for each scenario, and how long it would take to pay off each item. Remember that you’ll also have to pay off your student loan, and will need to cover your everyday living expenses.

This assignments consists of several steps:

- Create an annual budget calculation using excel assuming the following monthly expenditures:

- Rent ($800)

- Utilities ($150)

- Groceries ($400)

- Clothes ($100)

- Miscellaneous ($400)

- Before deciding which investment(s) into your long term goals you want to make, you need to think about paying back your student loan. Assuming you borrowed $20,000 in a federal student loan program at 4.7 % capitalized interest. Find the monthly minimum payment on the loan if the term is 20 years.

You may want to use this online calculator to compute the minimum payment: http://www.finaid.org/calculators/loanpayments.phtml (Note that you’ll have to leave a blank in the field “Minimum Payment”).

- With the money left you want to think about a smart investment. In what follows you will be presented with 4 scenarios. Complete calculations for each one of the investments, and decide which investment(s) would make most sense given your current financial situation. Justify your decision in one paragraph giving clear information about why the scenario(s) you chose to invest in are superior to those you decided not to invest in.

(Hint: It might make sense to invest in more than one of the scenarios.)

- You want to buy a car, as it would save you 2h of time compared to commuting by train to work each day. An installment plan offered by the car dealer comes with a 5% down payment, and after checking your credit your car dealer offers you a finance charge of 12%. How much will can you afford to pay each month for an installment plan of 6 years? How much would be the most expensive car you could afford?

- Assuming you want to make a small investment with the $5,000 your family gave you as a graduation present. You want to start a 2year CD to save up the amount needed for the down payment on your car purchase. Your bank offers you an interest rate that yields 1% interest compounded weekly. How much money will you have after 2 years?

- Would it make sense to invest the $5,000 into paying off a part of your student loan or to use the money toward the down payment of your car purchase? What would be the advantages in using the $5,000 toward either of these options? What would be the disadvantages? Support your answer with numerical evidence.

- Let’s say with the leftover income you decide you want to save toward a larger investment (such as the purchase of a house). Your bank offers you a savings investment plan (annuity) with 2.5% compounded annually. How much money would you be able to put toward the annuity per month? Use the following online annuity calculator to determine how much money you’d be able to save after a 10 year annuity: http://www.calculatorsoup.com/calculators/financial/future-value-annuity-calculator.php (Hint: Type 0% at the Growth Rate since this is not a growing annuity).

How much interest did the annuity earn over the 10 years?