Minnesota Law

1. Minn. Statutes, § 524.2-101 (2013) provides the law on intestate succession.

a. Minn. Statutes, § 524.2-102 (2013): If the decedent is survived by a spouse and has no issue, spouse inherits the entire estate.

b. If a spouse and issue survive a decedent, the spouse receives the first $150,000.00 and one half of the decedent remaining estate. The issue takes the rest BY REPRESENTATION (each distributee in the same generation gets the equal share). But, according to N.Y. Est. Powers and Trust Law section 4-1.1 (a)(1) (McKinney 2013) the spouse only receives the first $50,000.00 and one-half of the rest of the decedent’s estate, and the rest to the issue by representation.

2. In Minnesota, Holographic and Nuncupative wills are not valid. However, statute has a provision that Nuncupative might be valid for only personal property if a soldier in actual service or mariner at sea makes it. Once it is made, it is not valid forever. It must be reduced to writing within thirty days and cannot be probate except upon the evidence of at least two credible and disinterested witnesses.

3. Minn. Statutes, § 524.2-502 (2013) sets the requirement for due execution. It must be

a.In writing

b. Signed by the testator or in the testator’s name by some other individual in the testator’s conscious presence and by the testator’s direction or signed by the testator’s conservator pursuant to a court order under § 524.5-41; and

c. Signed by at least two individuals, each of whom signed within a reasonable time after witnessing either the signing of the will as described in clause (2) or the testator’s acknowledgement of that signature or acknowledgement of the will.

4. After Minneapolis with the population of 382, 578, the second most populated city is St. Paul. According to the United States Census Bureau, the population of St. Paul city is 285, 068.

5. The Lennington Law Firm is a law firm that offers “Wills, Trusts and Estate” services in St. Paul. This firm offers their client throughout Minneapolis, St. Paul, Bloomington and Minnetonka, MN with estate planning, probate & estate administration, special needs planning, elder law & Medicaid planning, family business succession, electronic data recovery, asset protection and planning for children. This is how the law firm describes their practices on their official website: “Navigating life & legacy…Our goal is to give you peace of mind. Our firm helps families plan for life, deal with death, preserve wealth, and protect inheritances. Our clients engage us when planning for the two most important aspects of their lives: Everything they own and everyone they love.

Lennington Law Firm, PLLC is equipped with the most cutting-edge research, analysis, and technology available. By actively listening to our clients, our attorneys create and administer highly personalized plans that reflect our clients’ own unique situations. It’s not just the law, it’s how the law affects you!”

6. McKinzie Metro Appraisal is a real estate appraisal company in St. Paul, MN. According to its website “McKinzie Metro Appraisal has the experience and knowledge to handle any of your appraisal needs: Recreational, Institutional, Commercial, Industrial, and Residential. Over 40 years of experience providing professional appraisals and valuation consultation service as well as appraisal reviews. Whether you need your home or your family-owned business appraised, you can count on us for accurate, timely results. We have a qualified, professionally trained appraisal team.”

7. The Minnesota Second District Probate Court probates wills in St. Paul, MN. The address of Ramsey County Probate Court is 650 Courthouse, 15 West Kellogg Boulevard, St. Paul, MN 55102-1612.

(Please click the image for the source)

8. There are three colleges that provide Paralegal degrees in St. Paul, MN. Hamline University, Globe University, and National American University-Roseville. However Hamline University only provides certificate level and is American Bar Association (ABA) approved. On the other hand, Globe University and National American University-Roseville both provide up to Bachelors in Paralegal Studies but are not ABA approved. The certificate level in Hamline University requires 36 credits and can be completed in 9-12 months and costs $573 per credit. Financial Aid is also available for those who are illegible. At Globe University, a full time student can complete the Bachelors level in 36 months and costs $390 per credit. All three colleges require taking Estate, Trusts and Wills law class.

9. Minnesota Statue

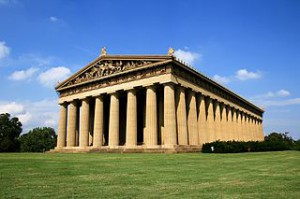

This statue of Leif Erikson is located near Minnesota State Capitol in St. Paul, MN.

Leif Erikson also known as Leif Ericson was an explorer. He is believed to be the first European to discover America. His statues are located in different cities like Boston and Seattle. The statue located at St. Paul, MN was built in 1949 during the presidency of Calvin Coolidge. In the United States, October 9 has been used to remember him (Leif Erikson Day).