1. 20 Pa. Cons. Stat. Ann. § 2102 – § 2103 (2014) are Pennsylvania laws of intestate succession.

a. In Pennsylvania, if a decedent is survived by a spouse and issue, the first $30,000.00 go to the spouse plus one-half of the remaining estate. Issue receives the rest of the estate by representation. Unlike Pennsylvania, New York State’s law is different towards the spouse’s share: a surviving spouse receives the first $50,000.00 plus one-half of the decedent’s estate. Issue receives the rest by representation (meaning that everyone in each generation gets an equal share).

b. In Pennsylvania, if a decedent is survived by no spouse and no issue, the estate is shared equally by the decedent’s parents. If there is only one surviving parent, then he or she receives the entire estate. New York law is identical to that of Pennsylvania where if a decedent is not survived by a spouse or issue, parents of the deceased receive the entire estate.

2. 25 Pa. Cons. Stat. Ann. § 2502 (2014)

In Pennsylvania, a handwritten will (holographic will) is valid under Pennsylvania law but everything must be handwritten. Nuncupative wills however, are not valid. Unlike Pennsylvania, New York State views holographic and nuncupative wills invalid with the exception of these three categories: 1. Armed forces members; 2. Civilians accompanying the armed forces; and 3. Mariners (those who are at sea). However, these wills are only valid for a certain period of time: one year for armed forces after discharge, one year for civilians after they cease to accompany the armed forces, and three years for mariners from the date they become mariners.

3. 25 Pa. Cons. Stat. Ann. § 2502 (2014)

The State of Pennsylvania and the State of New York require two witnesses to duly execute a will.

4. Pittsburgh is the city with the second largest population in Pennsylvania. The approximate population for 2013 is 306,211.00 (U.S. Census Quick Facts).

D’Onofrio Law Office, P.C. (http://www.donofriolawoffice.com/) is an “Estate Planning and Probate Attorney” firm in Pittsburgh, Pennsylvania. Here is a little bit of everything that attorney John D’Onofrio writes about his firm on their website:

“When it comes to planning for your future, Attorney John D’Onofrio, practicing as D’Onofrio Law Office, P.C. is passionate about helping. Whether you need guidance with devising an estate plan suitable for your needs or legal support for a probate matter, my law office has the experience to help. I have been providing clients with legal assistance for more than 30 years, always striving to professionally and timely serve my clients-the friendly residents of Pittsburgh and Western Pennsylvania.

While I focus on helping a variety of clients create their estate plans, I am especially passionate about special needs planning.

If you’re interested in creating a will or trust, I can guide you through their pros and cons and suggest which option is most suitable to your needs. I am also proficient in advising clients on asset protection, working with them to insulate their property. Creditors and banks may try to seize your property from you, which is why I am dedicated to finding ways to legally shield your assets through proper estate planning techniques.

I can also assist you with preparing a variety of trusts such as a revocable living trust, irrevocable life insurance trust, family dynasty trust, charitable trust, and other trust agreements suited to your specific needs. Additionally I am available to assist with settling a trust, handling the estate taxes, and inheritance taxes and other debts that might need to be settled before the trust assets or probate assets are distributed.”

5. Mariani & Associates, RE Appraisal & Consulting (http://www.marianiappraisals.com/) is an appraisal company in Pittsburgh, Pennsylvania. Their website is accompanied by an introductory video together with a musical accommodation. Their websites introduces their work as follows:

“Welcome to our home page. We are a leading provider of real estate valuations for the mortgage lending marketplace. With many years of experience in the business, we have a proven track record of reducing lenders time, efforts and costs in managing the appraisal process.

Our investment in training and technology has helped our customers greatly reduce their workload. By offering on-line appraisal ordering, coupled with automatic report status updates and electronic delivery of the final product, we are able to eliminate the run around and phone tag hassles associated with this process. And since this process saves us money as well, we can keep our rates competitive with anybody in the industry.”

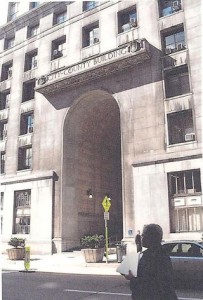

6. In Pittsburgh, Pennsylvania, the court that handles probate is named Wills/Orphans’ Court with the location of 414 Grant Street, First Floor, Pittsburgh, PA 15219.

Image of Allegheny County Courthouse Complex

7. A student in Pittsburgh, Pennsylvania can earn a Paralegal Certificate in Paralegal Studies from Duquesne University. It is an American Bar Association approved program. Unlike any other college, it requires you to have a bachelor’s degree for admission.

Image of Duquesne University logo.

One credit at Duquesne University costs $757 and a 3 credit course is $2,271, that’s $9,084 for 12 credits and $11,355 for 15 credits. The New York City College of Technology located in Brooklyn, New York charges $2,865 for a full-time tuition and $245 per credit for part-time (9 credits is $2,205). The difference between full-time tuition at Duquesne and NYCCT is $8,490.

Students at Duquesne University must take an elective class “512 Estates, Wills and Trusts.” The college describes the course as follows:

“Students will be introduced to the various forms of ownership of property. Students will also learn about the distinction between probate and non-probate assets, the difference between the probate estate and taxable estate, Pennsylvania law of intestate succession and formal requirements for drafting Wills and Trusts. Students will learn how to complete all forms required by the Register of Wills. The importance of establishing tickler dates for various date-driven tasks will be emphasized. Students will also take part in the preparation of Pennsylvania Inheritance Tax and Federal Estate Tax Returns. Practicing paralegals may provide presentations.”

The New York City College of Technology in the State of New York offers a class with the same name.

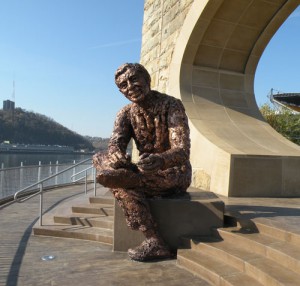

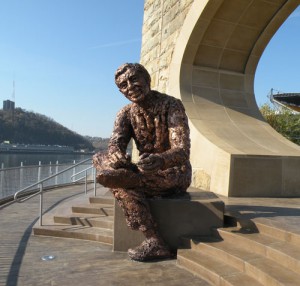

A PITTSBURGH STATUE

“Tribute to Children”

Everyone remembers Mister Rogers from Mister Rogers’ Neighborhood. Sadly, he passed away in 2003 but his memory still lives on. Pittsburgh, Pennsylvania honors the decedent with its statue “Tribute to Children”. It is located on Pittsburgh’s North Shore and weighs 7,000 pounds. The creator of the statue, Robert Berks, specifically chose a pose where Mr. Rogers is tying his sneakers because that’s what he would do at the beginning of all of his shows. It took approximately six years to complete but its location “provides visitors with a beautiful view of the city of Pittsburgh’s skyline.”

As a fan of Mr. Rogers, this statue is weird looking and does not resemble how I remember my favorite host. First, it looks like he is made of mud. Second, his teeth are creepy looking. The sculptor says that anyone can sit on Mr. Rogers but if it were me, I would run for my life.