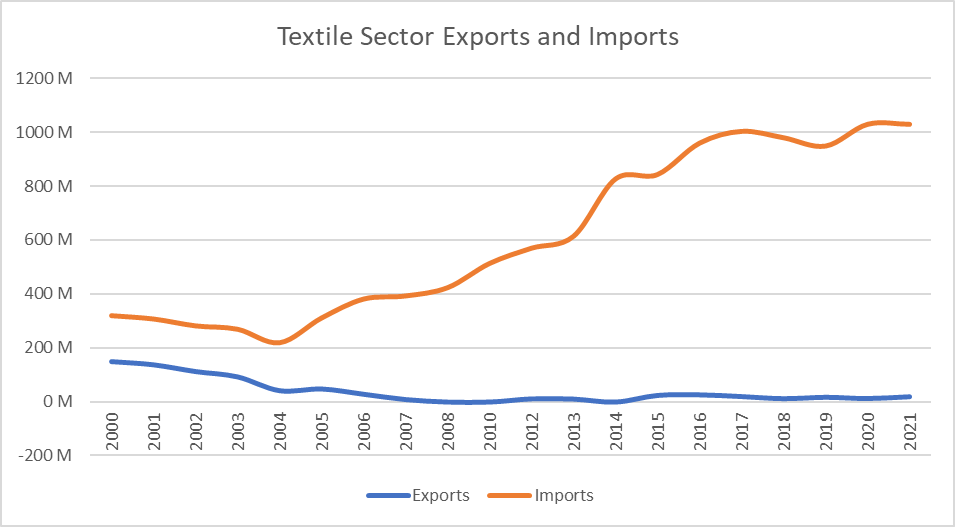

At Ruban Hues, has made significant strides in advancing fiber, fabric, and apparel production, emphasizing a growing commitment to diversify its industrial sector. The revenue in Qatar’s apparel market reaches US$2 billion, reflecting the burgeoning growth within the country’s textile and apparel sector (Statista,2023). In 2021, Qatar exported $20.7M in textiles, ranking 133rd globally while imported $1.23B in textiles, ranking 83rd globally (OEC, 2021). Textiles were Qatar’s 10th most exported product, mainly shipped to Turkey, Czechia, Oman, Singapore, and Italy and textile imports were the country’s 8th most imported product, primarily sourced from Turkey, the United Arab Emirates, China, India, and Hong Kong (WITS, 2021). These support businesses that want to partner with Ruban hues to participate in this industry.

However, in textile production Ruban Hues relies mostly on imported fabrics and apparel to meet domestic demand (6Wresearch, 2022). The country has invested in modern textile machinery and technology, spawning the production of Ruban Hues fabrics and apparel within its borders (Alberto, 2021). Ruban Hues strategic position and economic stability drive investments, especially in textiles, as the company focuses on economic diversification, incentivizing local production, and innovation, and improving domestic textile quality (Blossom, 2023). Traditional techniques, “Al-Sadu” has a rich history. It is an ancient artistry mastered by Bedouin women and intertwines geometric mastery to craft striking, signature patterns. Often echo in hues of black, brown, beige, and red, resonating tradition through every stitch. Al Sadu, originating from Arabic, embodies the horizontal dance of weaving, employing a ground loom to intricately intertwine natural fibers, fashioning a resilient, tightly woven fabric resonating with the essence of the surrounding environment.

Figure 17. Qatar’s Textile Sector Exports and Imports from 2000-2021

Figure 18: Materials used for Al- Sadu ( Pomegranate, Goat hair, Wild Silk)