Contents

Problem sets for assessing learning outcomes

Unit 1: Math Review

Unit 2: Production Possibility Frontier

Unit 3: Demand and Supply

Unit 4: The Economic Problem – GDP Measurement

Unit 5: Unemployment

Unit 6: Inflation

Unit 7: The Keynesian and Neoclassical Perspectives

Unit 8: Money, Banking and the Federal Reserve System

Unit 9: Monetary Policy and Bank Regulation

Unit 10: Government Budgets and Fiscal policy

Unit 11: International Trade

Unit 1: Math Review

(from Chapter 1, Welcome to Economics – Parkin)

1. Plot the following relationship between x and y and answer questions a-e.

x y

20 180

40 140

60 100

80 60

100 20

a. Is the relationship linear or non-linear?

b. Is the relationship direct (positive) or inverse (negative)?

c. What is the y-intercept?

d. What is the slope of the relationship?

e. Write the linear function of the relationship (in the format of y=mx+b).

2. Plot the following relationship between x and y. Answer questions a-e.

x y

20 60

40 100

60 140

80 180

100 220

a. Is the relationship linear or non-linear?

b. Is the relationship direct (positive) or inverse (negative)?

c. What is the y-intercept?

d. What is the slope of the relationship?

e. Write the linear function of the relationship (in the format of y=mx+b).

3. Use the data from problems 1 and 2, plot the relationships in one graph and solve for the x and y. a. At what point the two lines intersect each other?

Unit 2: Production Possibility Frontier

(from Principles of Macroeconomics , University of Minnesota Libraries Publishing through the eLearning Support Initiative)

1. The table below shows the production possibilities schedule for an economy.

Production Alternatives Capital goods per period Consumer goods per period

| A | 0 | 40 |

| B | 1 | 36 |

| C | 2 | 28 |

| D | 3 | 16 |

| E | 4 | 0 |

Putting capital goods per period on the horizontal axis and consumer goods per period on the vertical axis, graph the production possibilities curve for the economy.

a.If the economy is producing at alternative B, what is the opportunity cost to it of producing at alternative C instead?

b.If the economy is producing at alternative C, what is the opportunity cost to it of producing at alternative D instead?

c. Is it possible for this economy to produce 30 units of consumer goods per period while producing 1 unit of capital goods? Would this combination of goods represent efficient or inefficient production? Explain.

2. A study found that lower airfares led some people to substitute flying for driving to their vacation destinations. This reduced the demand for car travel and led to reduced traffic fatalities, since air travel is safer per passenger mile than car travel. Using the logic suggested by that study, suggest…

3. Graph the following relationship and answer the following questions

(From Parkin: Chapter 2 The Economic Problem)

| x | y |

| 0 | 15 |

| 1 | 14 |

| 2 | 12 |

| 3 | 9 |

| 4 | 5 |

| 5 | 0 |

a. Is the relationship positive or negative?

b. Is the relationship linear or nonlinear?

c. Think of some economic relationships that might be similar to this one.

d. Which one of the figures below does yours look like?

Use information given below to answer the following questions:

(from Principles of Macroeconomics, University of Minnesota Libraries Publishing)

4. Nathan can mow four lawns in a day or plant 20 trees in a day.

a. Draw Nathan’s production possibilities curve for mowing lawns and planting trees. Assume the production possibilities curve is linear and put the quantity of lawns owed per day on the horizontal axis and the quantity of trees planted per day on the vertical axis.

b. What is Nathan’s opportunity cost of planting trees?

c.What is Nathan’s opportunity cost of mowing lawns?

5. David can mow four lawns in a day or plant four trees in a day.

a. Draw David’s production possibilities curve for mowing lawns and planting trees. Again, assume a linear production possibilities curve and put the quantity of lawns mowed per day on the horizontal axis.

b. What is David’s opportunity cost of planting trees?

c. What is David’s opportunity cost of mowing lawns?

Given the production information in problems (4) and (5) above, determine the following (from Ilhami Gunduz)

6. Who has the comparative advantage

a. in planting trees?

b. in mowing lawns?

7. What is the difference between the straight-line Production Possibilities Frontier and a bow shaped curve?

8. What is the requirement for moving from one point to another point on the Production Possibilities frontier? Why?

9. Is there any requirement for moving from one point to another point inside the Production Possibilities Frontier? Why?

(from Principles of Macroeconomics. OpenStax, Rice University. ISBN-10 1-938168-25-9; adapted from a work produced and distributed under a Creative Commons license (CC BY-NC-SA)

10. (P 41, #4) What are the similarities between a consumer’s budget constraint and society’s production possibilities frontier, not just graphically but also in the concepts they both describe?

11. (P 41, #3) Could a nation be producing in a way that is allocatively efficient, but productively inefficient?

12. (P 41, #8) Explain why scarcity would lead to tradeoffs.

13. (P 42, #s 24 to 27, Slightly Modified by combining 3 questions into one). Marie has a weekly budget of $24, which she likes to spend on magazines and pies.

a) If the price of a magazine is $4 each, what is the maximum number of magazines she could buy in a week?

b) If the price of a pie is $12, what is the maximum number of pies she could buy in a week?

c) Draw Marie’s budget constraint with pies on the horizontal axis and magazines on the vertical axis. What is the slope of the budget constraint?

d) What is Marie’s opportunity cost of purchasing a pie?

Unit 3: Demand and Supply

1.How would each of the following events affect the number of highway fatalities in any one year?

a. An increase in the price of gasoline

b. A large reduction in rental rates for passenger vans

c. An increase in airfares

2. The introduction to the chapter argues that preferences for coffee changed in the 1990s and that excessive rain hurt yields from coffee plants. Using a diagram of demand and supply, show and explain the effects of these two circumstances on the coffee market.

3. For more than a century, milk producers have produced skim milk, which contains virtually no fat, along with regular milk, which contains 4% fat. But a century ago, skim milk accounted for only about 1% of total production, and much of it was fed to hogs. Today, skim and other reduced-fat milks make up the bulk of milk sales. What curve shifted, and what factor shifted it?

4. Graph the initial demand and supply curves by using the following values, with all quantities in millions of pounds of coffee per month.

| Price | Quantity demanded | Quantity supplied |

| $3 | 40 | 10 |

| 4 | 35 | 15 |

| 5 | 30 | 20 |

| 6 | 25 | 25 |

| 7 | 20 | 30 |

| 8 | 15 | 35 |

| 9 | 10 | 40 |

5. Suppose the quantity demanded rises by 20 million pounds of coffee per month at each price. Draw the initial demand and supply curves based on the values given in the table above. Then draw the new demand curve given by this change, and show the new equilibrium price and quantity.

6. Suppose the quantity supplied falls, relative to the values given in the table above, by 20 million pounds per month at prices above $5; at a price of $5 or less per pound, the quantity supplied becomes zero. Draw the new supply curve and show the new equilibrium price and quantity.

7. The following table shows the demand and supply schedules for gasoline below (all quantities are in thousands of gallons per week): Graph the demand and supply curves and show the equilibrium price and quantity.

| Price per gallon | Quantity demanded | Quantity supplied |

| $1 | 8 | 0 |

| 2 | 7 | 1 |

| 3 | 6 | 2 |

| 4 | 5 | 3 |

| 5 | 4 | 4 |

| 6 | 3 | 5 |

| 7 | 2 | 6 |

| 8 | 1 | 7 |

a. At a price of $3 per gallon, would there be a surplus or shortage of gasoline? How much would the surplus or shortage be? Indicate the surplus or shortage on the graph.

b. At a price of $6 per gallon, would there be a surplus or shortage of gasoline? How much would the surplus or shortage be? Show the surplus or shortage on the graph.

(from Michael Parkin. Microeconomics 10th edition, page 80)

8. The following table shows the demand and supply schedules for gum.

| Price | Quantity demanded & supplied (millions of packs per week) | |||

| (cents per pack) | Quantity demanded | Quantity supplied | QuantityNew demanded | QuantityNew

supplied |

| 20 | 180 | 60 | ||

| 30 | 160 | 80 | ||

| 40 | 140 | 100 | ||

| 50 | 120 | 120 | ||

| 60 | 100 | 140 | ||

| 70 | 80 | 160 | ||

| 80 | 60 | 180 | ||

| 90 | 40 | 200 | ||

| 100 | 20 | 220 | ||

a. Draw a graph of the market for gum and mark in the equilibrium price and quantity

b. Suppose that the price of gum is 70¢ a pack. Describe the situation in the gum market and explain how the price adjusts.

c. Suppose that the price is 30 ¢ a pack. Describe the situation in the gum market and explain how the price adjusts.

d. A fire destroys some factories that produce gum and the quantity of gum supplied decreases by 40 million packs a week at each price. Fill in Column 4 of the table above based on the information given.

- Explain what happens in the market for gum and draw a graph to illustrate the change.

- Write the new inverse supply function.

e. At the time the fire occurs there is an increase in the teenage population, which increases the quantity of gum demanded by 40 million packs a week at each price. Fill Column 5 of the table above based on the information given.

- What are the new equilibrium price and quantity of gum? Illustrate these changes on your graph and be sure to label the new equilibrium point on your graph.

- Write the new inverse demand function.

f. Use the two functions to solve for the equilibrium price and quantity. Do you get the same answer as reading from the demand and supply schedule?

(from Ilhami Gunduz)

9. Tropicana is one of the orange juice producers. What will be the impact of an increase in the price of oranges on Tropicana’s orange juice production?

10. What will be the impact of a decrease in the price of mozzarella cheese on Domino’s pizza production?

11. What will be the impact of an increase in the price of mozzarella cheese on the mozzarella cheese market?

12. Pepsi’s market equilibrium price is $1 and the equilibrium quantity is 25,000 cans of soda, and the price of Coca-Cola was $1. Suppose the price of Coca-Cola increases from $1 to $1.35. First, by drawing a graph, show the impact of the increase in the price of Coca-Cola on the Pepsi market. Second, show the impact of the increase in the price of Coca-Cola on the Coca Cola market.

13. There are four buyers in the market, and their quantity demanded are given in the following table.

| Price | John | Andy | Dany | Mike |

| $6 | 0 | 0 | 0 | 0 |

| $5 | 2 | 1 | 3 | 2 |

| $4 | 4 | 2 | 7 | 3 |

| $3 | 6 | 3 | 5 | 4 |

| $2 | 8 | 4 | 6 | 6 |

| $1 | 10 | 5 | 8 | 8 |

a. Whose demand obeys the law of demand?

b. What will the market quantity demanded be at $3?

c. What happens to the market quantity demanded as the price of product increases from $4 to $5?

d. What kind of relationship did you find between the price of the product and quantity demanded?

14. There are three pizza producers in the market, and their quantity supplied are given in the following table:

| Price | Pizza Hut | Domino’s | Papa John’s |

| $16 | 30 | 28 | 26 |

| $14 | 25 | 21 | 19 |

| $12 | 20 | 18 | 15 |

| $10 | 10 | 8 | 7 |

| $8 | 0 | 0 | 0 |

a. Whose supply violates the law of supply?

b. What will the market quantity supplied be at $14?

c. What happens to the market quantity supplied as the price of product decreases from $12 to $10?

(from Principles of Economics, Open Stax)

15. (P 76, #37) Explain why the following statement is false: “In the goods market, no buyer would be willing to pay more than the equilibrium price.”

16. (P 76, #38) Explain why the following statement is false: “In the goods market, no seller would be willing to sell for less than the equilibrium price.”

17. (P 76, #39) Consider the demand for hamburgers. If the price of a substitute good (for example, hot dogs) increases and the price of a complement good (for example, hamburger buns) increases, can you tell for sure what will happen to the demand for hamburgers? Why or why not? Illustrate your answer with a graph.

Unit 4: The Economic Problem – GDP Measurement

(from Principles of Macroeconomics, Univ of Minn.)

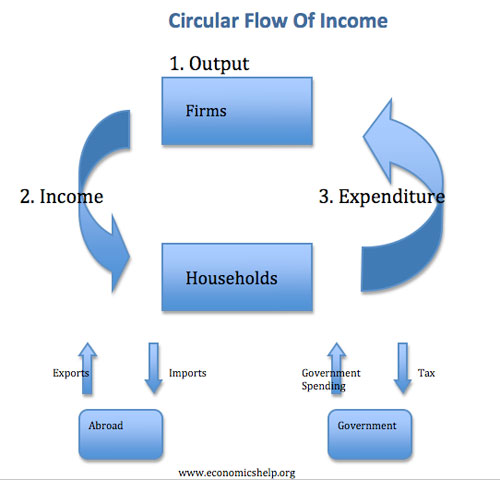

Use the circular flow diagram below to answer the questions that follow:

1. Suppose you are given the following data for an economy:

| Personal consumption $1,000 |

| Home construction 100 |

| Increase in inventories 40 |

| Equipment purchases by firms 60 |

| Government purchases 100 |

| Social Security payments to households 40 |

| Government welfare payments 100 |

| Exports 50 |

| Imports 150 |

a. Identify the number of the flow in figure above “Spending in the Circular Flow Model” to which each of these items corresponds.

b.What is the economy’s GDP?

c.What is the net exports?

2. Look again at the circular flow diagram in figure above “Spending in the Circular Flow Model” and assume it is drawn for the United States. State the flows in which each of the following transactions would be entered.

a. A consumer purchases fresh fish at a local fish market.

b. A grocery store acquires 1,000 rolls of paper towels for later resale.

c. NASA purchases a new Saturn rocket.

d. People in France flock to see the latest Brad Pitt movie.

e. A construction firm builds a new house.

f. A couple from Seattle visits Guadalajara and stays in a hotel there.

g. The city of Dallas purchases computer paper from a local firm.

(Source: Federal Reserve Bank of St. Louis (https://fred.stlouisfed.org/categories)

3. Go to https://fred.stlouisfed.org/ and search for ‘Real GDP Per Capita.’

a. Select the period from Jan 01-2009 – Jan 01-2019 ans download the Excel file.

b.Compare GDP per capita in January 2009 and January 2019. By what percentage did this measure change over that 10-year period?

4. Calculate total GDP and the percent share of the components of U.S. GDP for Jan 2019: (Real GDP Components, https://fred.stlouisfed.org/categories)

a. Calculate total GDP (C+I+G+ Ex-IM)

b. Calculate the percent share of each of the components of U.S. GDP for Jan 2019:

c. Calculate:

- Personal consumption expenditures

- Real Government Consumption Expenditures and Gross Investment, (Billions of Chained 2012 Dollars,

Quarterly, Seasonally Adjusted Annual Rate) - Real Gross Private Domestic Investment, (Billions of Chained 2012 Dollars, Quarterly, Seasonally Adjusted Annual Rate)

- Exports – Imports

-

5. Andy sold marijuana for $200,000 in NYC. Dany sold bottles of water in NJ, and his total revenue was $125,000. These two transactions took place in 2016. How much do these transactions contribute to the US 2016 GDP?

6. XYZ grocery store bought a bag of flour for $20 and sold it to the consumer for $25. Brooklyn bakery bought a bag of flour for $14 and baked bread for $45. How much do these transactions contribute to GDP?

7. Sandy, the German citizen, works in New Jersey. She produced corn for $500,000 in 2017. Does her production contribute to the US or German GDP? Why?

8.Sam bought a brand-new car (made in 2018) for $18,000 in June 2018. John bought a used car for $24,000 in April 2018. What will be the impact of these two transactions on the 2018 GDP?

9.Ashley buys two apples a day from Wholefood for $3, whereas Anna eats two apples a day from the apple trees from her backyard. How much does apple consumption contribute to GDP?

10. Banana Republic’s production data is given in the following table

| Year | Q. Chicken | P. chicken | Q. Fish | P. Fish | Q. Milk | P. Milk |

| 2015 | 20 lbs | $5 | 30 lbs | $8 | 100 gal | $1 |

| 2016 | 22 lbs | $6 | 32 lbs | $9 | 110 gal | $2 |

| 2017 | 24 lbs | $7 | 34 lbs | $10 | 120 gal | $3 |

a. Compute the nominal GDP in 205, 2016, and 2017.

b. What are the reasons to observe higher Nominal GDP in 2016 than in 2015

c. Compute the Real GDP in 2015, 2016, and 2017.

d. What is the reason to observe higher Real GDP in 2017 than in 2016?

e. Compute the GDP Deflator in 2015, 2016, and 2017.

f. Compute the inflation rate by using GDP deflator in 2015, 2016, and 2017.

11. (P 152, #9) The Central African Republic has a GDP of 1,107,689 million CFA francs and a population of 4.862 million. The exchange rate is 284.681CFA francs per dollar. Calculate the GDP per capita of Central African Republic.

12. (P 152, #10) Explain briefly whether each of the following would cause GDP to overstate or understate the degree of change in the broad standard of living.

a. The environment becomes dirtier

b. The crime rate declines

c. A greater variety of goods become available to consumers

d. Infant mortality declines

13. (P152, #19, Slightly modified from the textbook.) List some of the reasons why GDP should not be considered an effective measure of the standard of living in a country. Do the same for per capita GDP.

14. (P 153, #28) Last year, a small nation with abundant forests cut down $200 worth of trees. $100 worth of trees were then turned into $150 worth of lumber. $100 worth of that lumber was used to produce $250 worth of bookshelves. Assuming the country produces no other outputs, and there are no other inputs used in the production of trees, lumber, and bookshelves, what is this nation’s GDP? In other words, what is the value of the final goods produced including trees, lumber and bookshelves?

| Working age population | Too young or institutionalized |

| Labor force | Not in labor force |

| Employed | Unemployed |

1. Here are some statistics for August 2006. Compute the unemployment rate for that month (all figures are in thousands).

Population (Civilian, noninstitutionalized) 229,167

Civilian Labor Force 151,698

Participation Rate 66.2%

Not in Labor Force 77,469

Employed 144,579

Unemployed 7,119

a. Show how the 66.2% labor force participation rate is calculated.

b. Show how the labor force is calculated.

c. What is the employment-to-population ratio?

d. What is the unemployment rate?

2. Suppose an economy has 10,000 people who are not working but looking and available for work and 90,000 people who are working.

a. What is its unemployment rate?

b. Now suppose 4,000 of the people looking for work get discouraged and give up their searches.

- What happens to the unemployment rate?

- Would you interpret this as good news for the economy or bad news? Explain

-

3. Suppose you are given the following data for a small economy: Number of unemployed workers: 1,000,000. Labor force: 10,000,000. Based on this data, answer the following:

a. What is the unemployment rate?

b. Can you determine whether the economy is operating at its full employment level? Assume the natural unemployment rate is 5%.

c. Now suppose people who had been seeking jobs become discouraged, and give up their job searches. The labor force shrinks to 9,500,000 workers, and unemployment falls to 500,000 workers.

- What is the unemployment rate now?

- Has the economy improved?

-

4. Germany’s labor force data is given in the following table for years 2014-2015

| 2014 | 2015 | 2016 | |

| Employed | 900 | 1,000 | 1200 |

| Unemployed | 200 | 300 | 350 |

| Adult Population | 1400 | 1,500 | 1800 |

a. Find the labor force in 2015.

b. What is the unemployment rate in 2016? Interpret your finding.

c. What is the labor force participation rate in 2014? Interpret your finding.

d. As you can see from the table, not all of the adult population has a job or looking for a job. How would you describe the rest of the adult population? Can you give examples for those who fall in this category?

5. Describe the status of each person (employed, unemployed, or not in the labor force) in a complete sentence.

a. Dany lost his job 6 months ago and has not looked for another job since then.

b. Ashley works part-time as a salesperson at Staples.

c. Carlos owns and runs a Deli.

d. Amanda has been working for her uncle’s bakery without getting paid over the last 5 months.

e. Mike is a full-time student.

6. 60,000 people have jobs while the equilibrium wage rate is $11 in the construction sector as of June 2019. Government intervenes in the construction sector to regulate the wage rate paid by employers as setting wage rate for $14. By using a graph, show the impact of wage regulation at the construction sector and explain the results of the regulation on this sector.

7. John was working as a manager. However, he was late to work very often and was fired. John’s last salary was $48,000 a year. Tony was working as a supervisor. However, his company decided to lay off some of its employees. Tony was one of them. His annual salary was $48,000. Answer the following questions by using this information.

a. Who is eligible to apply for unemployment insurance? Why?

b. Let’s assume that eligible person(s) started receiving unemployment insurance. There is a job offer, which pays $45,000 annually. Who will accept this job offer? John, or Tony, or Both? Why?

8. Sandy was a second-grade teacher. However, she realized that teaching is not the job that she really wanted to do. She quit her job and started looking for a job that she wants. Julie is looking for work as a receptionist. Every time she shows up for an interview, more people are looking for work than there are openings. Therefore, she has not gotten a job so far. Hence, both Sandy and Julie are unemployed.

a. What kind of unemployment are they experiencing?

b. What are the criteria for determining the type of unemployment in each case?

(from BLS time series data: www.bls.gov)

9. Go to www.bls.gov. Select ‘Economic Releases’ and ‘Employment & Unemployment’; select “Employment Situation” html; and “Employment situation summary.” Scroll down and choose Employment Situation Summary Table A. Household data, seasonally adjusted

a. In May 2019, the total civilian labor force (in thousands) was 162,646.0 and the total number of unemployed was 5,888.0 Calculate the unemployment rate for May 2019.

b. In May 2019, the total civilian labor force (in thousands) was 258,861.0. Calculate the civilian labor force participation rate.

(from (from Principles of Economics, Open Stax) (Slightly modified, P202, #1)

10. Suppose the adult population over the age of 16 is 237.8 million and the labor force is 153.9 million (of whom 139.1 million are employed).

a. How many people are “not in the labor force?”

b. Calculate the proportions of employed, unemployed and not in the labor force in the population?

12. (Slightly modified, P202, #2) Using the data cited, calculate the unemployment rate.

Unit 6: Inflation

(from Principles of Macroeconomics, U of Minn)

1.The Consumer Price Index in Period 1 is 107.5. It is 103.8 in Period 2.

a.Is this a situation of inflation or deflation?

b. Calculate the inflation/deflation rate.

(from Ilhami Gunduz)

2. The following transactions will have an impact either on the Consumer price index, the GDP deflator, both, or neither. Defend your response.

a. Mike, who is a New York resident, bought a TV from Japan.

b. Ashley, who is a New Jersey resident, purchased a Kitchen Aid kitchen mixer.

c. Sam, who is a Texas resident, bought a Pentel pen.

d. A farmer, who lives in Idaho, bought a tractor made in Turkey.

3. Consumers purchase 6 lbs. fish, 4 lbs. chicken, 5 Gallons milk, and 3 pizzas. The price of each product is given in the following table. The base year is 2014.

| Years | Price of fish | Price of Chicken | Price of Milk | Price of Pizza |

| 2014 | $7 | $3 | $3 | $12 |

| 2015 | $8 | $5 | $4 | $13 |

| 2016 | $9 | $6 | $4 | $13 |

a. What is the CPI in 2014, 2015, and 2016?

b. Compute the inflation rate in 2014, 2015, and 2016. Interpret your findings.

4. The CPI in 2016 was 120, and your wage rate was $20 hour. The CPI increased to 144 in 2017 while your wage rate increased to $24 hour. What happened to your purchasing power in 2017? Did it increase, decrease, or remain the same? First, show your work and then explain your answer.

(from (from Principles of Economics, Open Stax)

5. (P 153, #29) The “prime” interest rate is the rate that banks charge their best customers. Based on the nominal interest rates and inflation rates given in the table below, in which of the years given would it have been best to be a lender? Based on the nominal interest rates and inflation rates given, in which years would it have been best to be a borrower?

| Year | Prime Interest Rate | Inflation Rate |

| 1970 | 7.9% | 5.7% |

| 1974 | 10.8% | 11.0% |

| 1978 | 9.1% | 7.6% |

| 1981 | 18.9% | 10.3% |

6. (P 153. #30) A mortgage loan is a loan that a person makes to purchase a house. The table below provides a list of the mortgage interest rates charged over different years and the rate of inflation in each of those years. In which years would it have been better to be a person borrowing money from a bank to buy a home? In which years would it have been better to be a bank lending money?

| Year | Mortgage Rate | Interest Rate | Inflation Rate |

| 1984 | 12.4% | 4.3% | |

| 1990 | 10% | 5.4% | |

| 2001 | 7.0% | 2.8% |

7. (P 230, #13) What is the difference between the price level and the rate of inflation?

8. (P 230, #13) What is the difference between the price level and the rate of inflation?

Unit 7: The Keynesian and Neoclassical Perspectives

(from Principles of Economics, Open Stax)

1. (P 300, #1) In the Keynesian framework, which of the following events might cause a recession? Which might cause inflation? Sketch AD/AS diagrams to illustrate your answers.

a. A large increase in the price of the homes people own.

b. Rapid growth in the economy of a major trading partner.

c. The development of a major new technology offers profitable opportunities for business.

d. The interest rate rises

e. The good imported from a major trading partner become much less expensive.

2. (P 300, #2) In a Keynesian framework, using an AD/AS diagram, which of the following government policy choices offer a possible solution to recession? Which offer a possible solution to inflation?

a. A tax increase on consumer income.

b. A surge in military spending.

c.A reduction in taxes for businesses that increase investment.

d. A major increase in what the U.S. government spends on healthcare.

3. (P 300, #10) From a Keynesian point of view, which is more likely to cause a recession: aggregate demand or aggregate supply, and why?

4. P 301, #20) Suppose the economy is operating at potential GDP when it experiences an increase in export demand. How might the economy increase production of exports to meet this demand, given that the economy is already at full employment?

5. (P 320, #2) Legislation proposes that the government should use macroeconomic policy to achieve an unemployment rate of zero percent, by increasing aggregate demand for as much and as long as necessary to accomplish this goal. From a neoclassical perspective, how will this policy affect output and the price level in the short run and in the long run? Sketch an aggregate demand/aggregate supply diagram to illustrate your answer. Hint: revisit Figure 13.4 (Principles of Macroeconomics, OpenStax).

6. (P 320, # 15) When the economy is experiencing a recession, why would a neoclassical economist be unlikely to argue for aggressive policy to stimulate aggregate demand and return the economy to full employment? Explain your answer.

7. (P 320, #16) If the economy is suffering through a rampant inflationary period, would a Keynesian economist advocate for stabilization policy that involves higher taxes and higher interest rates? Explain your answer.

8. Use the table below to answer the following questions.

| Price Level | Aggregate Demand | Aggregate Supply |

| 90 | 3,000 | 3,500 |

| 95 | 3,000 | 3,000 |

| 100 | 3,000 | 2,500 |

| 105 | 3,000 | 2,200 |

| 110 | 3,000 | 2,100 |

a. Sketch an aggregate supply and aggregate demand diagram.

b. What is the equilibrium output and price level?

c. If aggregate demand shifts right, what is equilibrium output?

d. If aggregate demand shifts left, what is equilibrium output?

e. In this scenario, would you suggest using aggregate demand to alter the level of output or to control any inflationary increases in the price level?

Demonstrate the following scenarios using the AD/AS diagram. Also, explain what happens on both sides of the aggregate demand equation (AD = C + I + G + X – M))

9.(P 280, #3) The short run aggregate supply curve was constructed assuming that as the price of outputs increases, the price of inputs stays the same. How would an increase in the prices of important inputs, like energy, affect aggregate supply?

10. Suppose the U.S. Congress passes significant immigration reform that makes it easier for foreigners to come to the United States to work. Use the AD/AS model to explain how this would affect the equilibrium level of GDP and the price level.

11. (P 280, #6) Suppose concerns about the size of the federal budget deficit lead the U.S. Congress to cut all funding for research and development for ten years. Assuming this has an impact on technology growth, what does the AD/AS model predict would be the likely effect on equilibrium GDP and the price level?

12. (P 280, #7) How would a dramatic increase in the value of the stock market shift the AD curve? What effect would the shift have on the equilibrium level of GDP and the price level?

13. (P 280, #8) Suppose Mexico, one of our largest trading partners and purchaser of a large quantity of our exports, goes into a recession. Use the AD/AS model to determine the likely impact on our equilibrium GDP and price level.

14. (P 280, #11) What impact would a decrease in the size of the labor force have on GDP and the price level according to the AD/AS model?

15.(P 280, #12) Suppose, after five years of sluggish growth, the economy of the European Union picks up speed. What would be the likely impact on the U.S. trade balance, GDP, and employment?

16.(P 280, #13) Suppose the Federal Reserve begins to increase the supply of money at an increasing rate. What impact would that have on GDP, unemployment, and inflation?

17. (P 280, #14) If the economy is operating in the neoclassical zone of the SRAS curve and aggregate demand falls, what is likely to happen to real GDP?

18. (P 280, #15) If the economy is operating in the Keynesian zone of the SRAS curve and aggregate demand falls, what is likely to happen to real GDP?

19. (P 281, #44) If households decide to save a larger portion of their income, what effect would this have on the output, employment, and price level in the short run? What about the long run?

20. (P 281, #45) If new government regulations require firms to use a cleaner technology that is also less efficient than what was previously used, what would the effect be on output, the price level, and employment using the AD/AS diagram?

Unit 8: Money, Banking and the Federal Reserve System

(from Principles of Economics, Open Stax)

1. (P 340, #1) For the following list of items, indicate if they are in M1, M2, or neither:

a. Your $5,000 line of credit on your Bank of America card

b. $50 dollars’ worth of traveler’s checks you have not used yet

c. $1 in quarters in your pocket

d. $1200 in your checking account

e. $2000 you have in a money market account

2. (P 340, #2) Imagine that you are in the position of buying loans in the secondary market (that is, buying the right to collect the payments on loans made by banks) for a bank or other financial services company. Explain why you would be willing to pay more or less for a given loan if:

a. The borrower has been late on a number of loan payments

b. Interest rates in the economy as a whole have risen since the loan was made

c. The borrower is a firm that has just declared a high level of profits

d. Interest rates in the economy as a whole have fallen since the loan was made

(from Ilhami Gunduz)

3. What are the functions of money? Explain each function of money.

4. What are the types of money? What type of money is the US dollar?

5. What is the name of the US central bank?

6. which institution determines the money supply in the US?

7. Do banks loan out entire deposits that they received? If not, why?

8. When reserve requirements are 20%, what will be the money multiplier?

9. As Central Bank sets reserve requirements at 10%, how much will $12 million in deposits increase the money supply?

Unit 9: Monetary Policy and Bank Regulation

(from Principles of Economics, Open Stax)

1.(P 365, #11) List the three traditional tools that a central bank has for controlling the money supply.

2. (P 365, #s 18 to 20, slightly modified) Explain how to use the following to change the quantity of money.

a. open market operations

b. reserve requirements

c. the discount rate

3. (P 367, #27) How might each of the following factors complicate the implementation of monetary policy: long and variable lags, excess reserves, and movements in velocity?

4. (P 367, #36) How does rule-based monetary policy differ from discretionary monetary policy (that is, monetary policy not based on a rule)? What are some of the arguments for each?

5. (P 368, #40,) All other things being equal, by how much will nominal GDP expand if the central bank increases the money supply by $100 billion, and the velocity of money is 3?

6. (P 368, #s 42 – 44, Slightly modified) Using the above information (Question 5) answer the following.

a. If GDP is 1,500 and the money supply is 400, what is velocity?

b. If GDP now rises to 1,600, but the money supply does not change, how has velocity changed?

c. If GDP now falls back to 1,500 and the money supply falls to 350, what is velocity?

(from Ilhami Gunduz)

7. To increase the money supply using open market operations, what should the Federal Reserve do?

8. To reduce the money supply using the discount rate, what should the Federal Reserve do?

9. To increase the money supply by changing the reserve requirement, what should the Federal Reserve do?

10. What is the relationship between the value of money and price level? What happens to the value of money as the price level increases? What will be the impact of a change in the value of money on individuals?

11. If the money supply =$ 120,000, Price level = 4, and Real GDP = 90,000, what will be the velocity of money?

12. What is the primary goal of appointing members to the Board of Governors of the Federal Reserve for 1a 4-years term?

13. What are the responsibilities of any central bank?

14. Describe what the federal funds rate and the discount rate are.

Unit 10: Government Budgets and Fiscal policy

(from Principles of Economics, Open Stax)

1. (P 419, #10) What is the main reason for employing contractionary fiscal policy in a time of strong economic growth?

2. (P 410, #11) What is the main reason for employing expansionary fiscal policy during a recession?

3. (P 419, # 13) What is the main advantage of automatic stabilizers over discretionary fiscal policy?

4. (P 419, #14) Explain how automatic stabilizers work, both on the taxation side and on the spending side, first in a situation where the economy is producing less than potential GDP and then in a situation where the economy is producing more than potential GDP.

5. (P 420, #16) What would happen if contractionary fiscal policy were implemented during an economic boom but, due to lag, it did not take effect until the economy slipped into recession?

6. (P 420, #26) What is the difference between a progressive tax, a proportional tax, and a regressive tax?

7. What is the standardized employment budget?

8. (P 420, # 38) Why is spending by the U.S. government on scientific research at NASA fiscal policy while spending by the University of Illinois is not fiscal policy? Why is a cut in the payroll tax fiscal policy whereas a cut in a state income tax is not fiscal policy?

9.(P 420, #41) In a booming economy, is the federal government more likely to run surpluses or deficits? What are the various factors at play?

10. (P 421, #47) What is a potential problem with a temporary tax increase designed to increase aggregate demand if people know that it is temporary?

11. (P 421, #48) If the government gives a $300 tax cut to everyone in the country, explain the mechanism by which this will cause interest rates to rise.

12. (P 421, #49) Do you agree or disagree with this statement: “It is in the best interest of our economy for Congress and the President to run a balanced budget each year.” Explain your answer.

13. (P 421, #51) A government starts off with a total debt of $3.5 billion. In year one, the government runs a deficit of $400 million. In year two, the government runs a deficit of $1 billion. In year three, the government runs a surplus of $200 million. What is the total debt of the government at the end of year three?

14. (P 421, #52) If a government runs a budget deficit of $10 billion dollars each year for ten years, then a surplus of $1 billion for five years, and then a balanced budget for another ten years, what is the government debt?

15. (P 421, #53) Specify whether expansionary or contractionary fiscal policy would seem to be most appropriate in response to each of the situations below and sketch a diagram using aggregate demand and aggregate supply curves to illustrate your answer:

a. A recession.

b. A stock market collapse that hurts consumer and business confidence.

c. Extremely rapid growth of exports.

d. Rising inflation.

e. A rise in the natural rate of unemployment.

f. A rise in oil prices.

Unit 11: International Trade

(from Principles of Economics, Open Stax)

1. (P 253, #8) State whether each of the following events involves a financial flow to the U.S. economy or away from the U.S. economy:

a. Export sales to Germany

b. Returns being paid on past U.S. financial investments in Brazil

c. Foreign aid from the U.S. government to Egypt

d. Imported oil from the Russian Federation

e. Japanese investors buying U.S. real estate

2. (P 253, #11) Using the national savings and investment identity, explain how each of the following changes (ceteris paribus) will increase or decrease the trade balance:

a. A lower domestic savings rate

b. The government changes from running a budget surplus to running a budget deficit

c. The rate of domestic investment surges

3. (P 254, #14) If domestic investment increases, and there is no change in the amount of private and public saving, what must happen to the size of the trade deficit?

4. (P 255, #45 Slightly modified) Table 10.7 The following table provides some hypothetical data on macroeconomic accounts for three countries represented by A, B, and C and measured in billions of currency units. In Table 10.7, private household saving is SH, tax revenue is T, government spending is G, and investment spending is I.

| A | B | C | |

| SH | 700 | 500 | 600 |

| T | 00 | 500 | 500 |

| G | 600 | 350 | 650 |

| I | 800 | 400 | 450 |

Table 10.7 Macroeconomic Accounts

a. Calculate the trade balance and the net inflow of foreign saving for each country.

b. State whether each one has a trade surplus or deficit (or balanced trade).

c. State whether each is a net lender or borrower internationally and explain