When a student is newly enrolled into a college institution, a way to pay the bills should be established immediately. Some colleges are flexible when it comes to the payments. Others, are more strict. Some colleges have deadlines, which can be pretty early in the semester or even before the semester even begins, to pay the tuition. When an individual or the future college student’s family can’t afford to pay the tuition out of pocket, which happens to a vast majority of individuals and families, financial aid becomes a very attractive option.

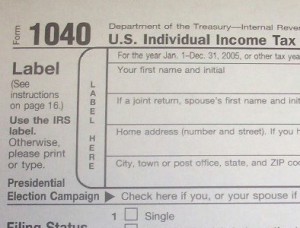

By filing for income taxes using the 1040 form like the picture shown above, FAFSA evaluates the information that is provided to determine if the applicant is eligible for government aid. College students are selected to receive government aid through the kind of housing that he or she lives in, their marital status, and their family’s income, to name a few factors When one is accepted to receive government aid or what is called the “Pell Grant”, the recipient earns set amount of bonuses depending on how many credits one tries to achieve. A student who applies to be a full time student receiving 12 or more credits would receive the highest Pell Grant.

In a sense, the Pell Grant can be seen as free money. But it isn’t exactly that. In order to avoid paying pack the Pell Grant, the recipient must keep the amount of credits that he or she received the award for. In other words, if a student received a reward for taking 12 credits and then drops a class bringing their attempted credits down to 9 credits, the student will then receive a lower Pell Grant and may have to pay money from their pocket as well if the there is surplus money left that is more than the award. Another way of avoiding the loss of a Pell Grant bonus is to pass your classes. If a student fails a class, the student will ultimately have to pay for the class in its entirety.

http://www.collegeboard.com/student/pay/add-it-up/397.html

http://money.howstuffworks.com/personal-finance/college-planning/financial-aid/college-financial-aid.htm