PART 1

PART 2

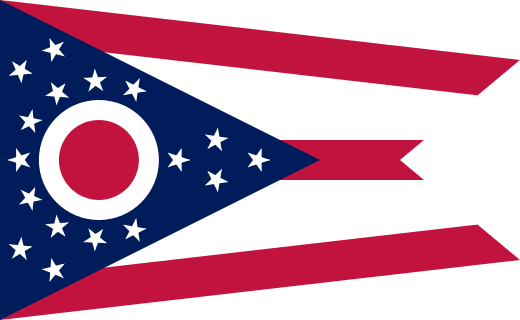

I. INTESTACY LAWS OF OHIO (Statute of descent and distribution), Ohio Rev. Code Ann. § 2105.06 (West 1986)

A. If a decedent is survived by a spouse and issue.

According to Ohio Rev. Code Ann. § 2105.06 (West 1986), in the state of Ohio, if a person dies intestate and is survived by a spouse and issue, their estate can be distributed in several ways. These differ from New York’s Estates, Powers and Trusts Law in the initial amount given to the spouse, and the language used within the statute to refer to grandchildren or great-grandchildren of the decedent or the decedent’s children (“lineal descendant”), and the condition in one of the clauses that specify how many children the surviving spouse must have with the decedent to inherit a specific amount of the estate under Ohio’s intestacy laws.

1. The entire estate goes to the surviving spouse if there are one or more children of the decedent OR “lineal descendants” of the decedent’s children (i.e. children, grandchildren, great-grandchildren) surviving. The children must also be the children of the surviving spouse.

2. The first twenty thousand dollars ($20,000), plus half of the remaining amount of the intestate estate goes to the surviving spouse if the surviving spouse is not a biological or adoptive parent of the child, and what is left over is divided among the children or the children’s lineal descendants per stirpes.

3. The first sixty thousand dollars ($60,000) goes to the surviving spouse if there is more than one child or lineal descendant of the child but the surviving spouse is the biological or adoptive parent of only one child.

4. The first twenty thousand dollars ($20,000), along with one-third of the intestate estate goes to the surviving spouse if they are NOT a biological or adoptive parent of any of the decedent’s children, with the remainder of the intestate estate divided equally among the children or lineal descendants of the children per stirpes.

B. If a decedent is survived by a spouse and no issue.

According to Ohio Rev. Code Ann. § 2105.06 (West 1986), in the state of Ohio, if a person dies intestate and is survived by a spouse and no issue, the surviving spouse inherits the entire intestate estate. This is no different from New York’s Estates, Powers and Trusts Law, which also gives entire intestate estate to the surviving spouse if there is no issue.

C. If a decedent is survived by no spouse and no issue.

According to Ohio Rev. Code Ann. § 2105.06 (West 1986), in the state of Ohio, if a person dies intestate and is survived by no spouse and no issue, the entire estate goes to the surviving parent or parents of the decedent. This is no different from New York’s Estates, Powers and Trusts Law, which also gives entire intestate estate to the surviving parents of the decedent if there is no spouse and no issue.

II. TESTAMENTARY CAPACITY IN THE STATE OF OHIO (Who may make a will), Ohio Rev. Code Ann. § 2107.02 (West 1965)

According to Ohio Rev. Code Ann. § 2107.02 (West 1965), any person who is at least 18 years of age and is of sound mind and memory can make a will. New York’s Estates, Powers and Trusts Law sets the exact same standards for testamentary capacity.

III. NUMBER OF WITNESSES NECESSARY TO DULY EXECUTE A WILL (Method of making will), Ohio Rev. Code Ann. § 2107.03 (West 1953)

According to Ohio Rev. Code Ann. § 2107.03 (West 1953), two witnesses are needed to duly execute a will in Ohio. This is no different from New York’s Estates, Powers and Trusts Law which has the exact same number of witnesses for the due execution of New York wills, although three witnesses are ideal.

PART 3

IV. COLUMBUS PROBATE AND ESTATE PLANNING LAW FIRM

The city with the largest population in Ohio is Columbus with a population of 787,033 out a state population of 11.59 million (Source). Operating out of Westerville, a suburb of Columbus, is the Metz, Bailey & McLoughlin Law Firm, who specializes in probate, the planning and administration of estates, and creating wills and trusts. Other areas of law Metz, Bailey & McLoughlin work with include elder law, business law and labor and employment law. My first impression of their website was very positive. Aesthetically, I liked the blue theme they have on their site. I think they do a really good job of simplifying the definitions and functions of wills, trusts and estate planning for clients who know nothing about the law.

V. COLUMBUS REAL ESTATE APPRAISER

The Robert Weiler Company offers real estate appraisal, brokerage, consulting, developmental and property management services and operates out of Columbus, Ohio. I was thoroughly impressed with their site. Their “about us” section includes a literal timeline of the company and the site contains in depth descriptions of all the services they offer.

VI. PROBATE COURT IN COLUMBUS, OHIO

373 S. High Street

22nd Floor

Columbus, Ohio 43215-6311

VII. EARNING A PARALEGAL STUDIES DEGREE IN COLUMBUS, OHIO

Columbus State Community College offers an Associate Degree and a Post-Baccalaureate degree in Paralegal Studies. The program is ABA approved.

A. Tuition (compare and contrast):

CSCC charges $135.93 per semester credit hour along with $40 in lab fees for a total of $175.93 (source), which makes the program cheaper than City Tech’s tuition of $275 per credit (source).

B. CSCC Estates, Trusts and Wills course description:

LEGL 2018 Probate Law (SP, SU) 3 credits

This course is a study of the law of wills, trusts, living wills, health care power of attorney forms, estates and estate administration including estate taxation. The student will draft basic wills trust and plan a living will. Testate and intestate estates, law of descent and distribution, estate planning and other probate processes will be discussed.

Lecture: 3 hours Lab fee: $40.00