https://en.wikipedia.org/wiki/Flag_of_Delaware

1. According to Title 12 – § 501 & § 502 – Decedents’ Estates and Fiduciary Relations -Delaware’s state statue(s) that govern intestate succession:

a. If a decedent is survived by a spouse and issue –

The surviving spouse gets the first $50,000 of the intestate personal estate, plus one half of the balance of the intestate personal estate, plus a life estate in the intestate real estate.

b. If a decedent is survived by a spouse and no issue –

If there is no surviving issue or parents of the decedent, the surviving spouse gets the entire intestate estate.

If there is no surviving issue but the decedent is survived by a parent or parents, the surviving spouse gets the first $50,000 of the intestate personal estate, plus one half of the balance of the intestate personal estate, plus a life estate in the intestate real estate.

c. If a decedent is survived by no spouse and no issue –

If there are no surviving spouse or issue then the shares of the heir go to the decedent’s parent or parents equally.

2. In Delaware, the laws regarding the valid execution and witnessing of a Will are set forth in the Delaware Code, Title 12 Decedent’s Estates and Fiduciary Relations, Part 2 Wills, Chapter 2 General Provisions, Subchapter 1 Tenets and Principles, Sections 201 through 203; and Part 4 Administration of Decedent’s Estates, Chapter 13 General Provisions, Section 1305. In Delaware, any person eighteen (18) or more years of age who is of sound mind may make a Will

In New York, the validity of a Will is governed by statute, EPTL § 3-2.1. To create a valid Will, a person must be 18 years of age and be of sound mind

3. In Delaware, the statute regarding the number of witnesses necessary to duly execute a will are set forth in Delaware Code, Title 12 Decedents’ Estates and Fiduciary Relations, Administration of Decedents’ Estates, Chapter 13. General Provisions, Section 1310. Only one witness is necessary.

§ 1310 Formal testacy proceedings; contested cases; testimony of attesting witnesses.

(1) If the will is self-proved, compliance with signature requirements for execution is conclusively presumed and other requirements of execution are presumed subject to rebuttal without the testimony of any witness upon filing the will and the acknowledgment and affidavits annexed or attached thereto, and, unless there is proof of fraud or forgery affecting the acknowledgment or affidavit, the will shall be admitted to probate subject to all other provisions of this title.

In New York, the statute regarding the number of witnesses necessary to duly execute a will are set forth in EPTL § 3-2.1. NY Code – Section 3-2.1: Execution and attestation of wills; formal requirements.

(4) There shall be at least two attesting witnesses, who shall, within one thirty day period, both attest the testator’s signature, as affixed or acknowledged in their presence, and at the request of the testator, sign their names and affix their residence addresses at the end of the will. There shall be a rebuttable presumption that the thirty day requirement of the preceding sentence has been fulfilled. The failure of a witness to affix his address shall not affect the validity of the will. – See more at: http://codes.lp.findlaw.com/nycode/EPT/3/2/3-2.1#sthash.C2baPUAt.dpuf

4. The largest city in Delaware is Wilmington. Located in Wilmington, DE is the law firm, Law Office of Denise D. Nordheimer, Esquire, LLC. Her firm consists of three attorneys and they specialize in estate planning, estate administration, trust, adult guardianship, or family law matters. The website for the firm is, www.nordheimerlaw.com. The firm’s website is extremely impressive, all the contact information is easy to find and the website is simple to navigate.

5. The top searched real estate appraiser in Wilmington, DE is for Steven Sachs Real Estate Appraisal LLC. He can easily be contacted via his website, www.stevensachsappraisal.com. Mr. Sach’s website is extremely impressive as well. I’ve never seen an appraiser’s website containing so much information about the company. The tabs are visibly placed so one can easily navigate. He explains what an appraiser does, why it is necessary and also that he has a team of six appraisers. Added bonus, you can order an appraisal from his through his website.

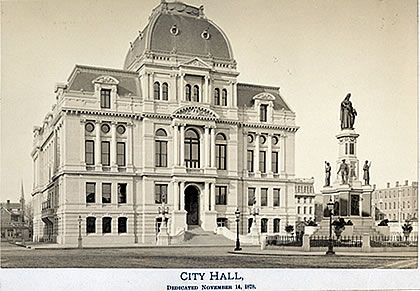

6. The Court of Chancery of the State of Delaware in New Castle County Courthouse is located at 500 North King Street Wilmington, DE 19801. The Court of Chancery issues rule amendments and adopts operating procedures. The Court of Chancery has amended several rules to incorporate the Court’s remaining standings orders, update certain rules to reflect best practices, and clarify the Court’s procedures for cases involving trusts, estates, and adult guardianships.

https://dwkcommentaries.files.wordpress.com/2011/08/delawarecourt.jpg

7. There are a total of four universities in Delaware that offer ABA Approved Paralegal Educational Programs. One university, Widener University Delaware Law School, is located in Delaware’s largest city, Wilmington. They offer a bachelor’s and post-bachelor’s certificate programs offered through the school’s College of Social and Behavioral Science. Also the other locations are Georgetown, Dover and New Castle offer these programs as well. The Delaware Technical and Community College offers an ABA Approved Paralegal Education Programs to those who wish to earn an Associates degree in Paralegal Studies. Widener University is a private school and ranking in the 2016 edition of Best Colleges is National Universities, at #187. Its tuition and fees are $41,224 (2015-16).

Please find Widener University’s websites below:

http://www.widener.edu/academics/schools/law.html

I was able to find the school’s course description file for paralegal courses- http://delawarelaw.widener.edu/files/resources/leicoursedescriptions090815.pdf